what is fsa health care 2020

Its a popular option in many employer. Contributions made to an FSA are not subject to taxes.

Flexible Spending Accounts Uk Human Resources

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

. 31 deadline for using the money some have a grace period to March 15 or let you carry over 550 from one year to the next. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by. The 2021 Healthcare Flexible Spending Account contribution limit is 2750.

It can be used for over-the-counter medications allergy drugs first-aid supplies and digestive health. What is the FSA amount for 2020. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021.

The limit for 2022 contributions is 2850 up from 2750 in 2021. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical. A full FSA is a benefits account to which you contribute pre-tax funds money deducted from your paycheck before payroll taxes are calculated.

An Flexible Spending Account FSA is a valuable. The IRS has not yet. The smart Trick of Health Care Policy - Boundless Political Science That Nobody is Talking About shows some particular procedures of utilization that represent the cost data highlighted in.

The IRS determines which. For 2020 Healthcare FSA plan years the available runout period-to accommodate the Agencies guidance concerning the individual application of plan deadline relief-applicable deadlines for individuals and plans that fall within the Outbreak Period will be extended on a case-by-case basis until the earlier of 1 the end of the Outbreak Period. FSA funds are meant to be used within one plan year though you may be given up to 2 ½ months extra as a grace period to spend unused funds or you may be able to roll over 500.

If theres a balance at the end of the year your employer may offer options. Or 2 one year from the. An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

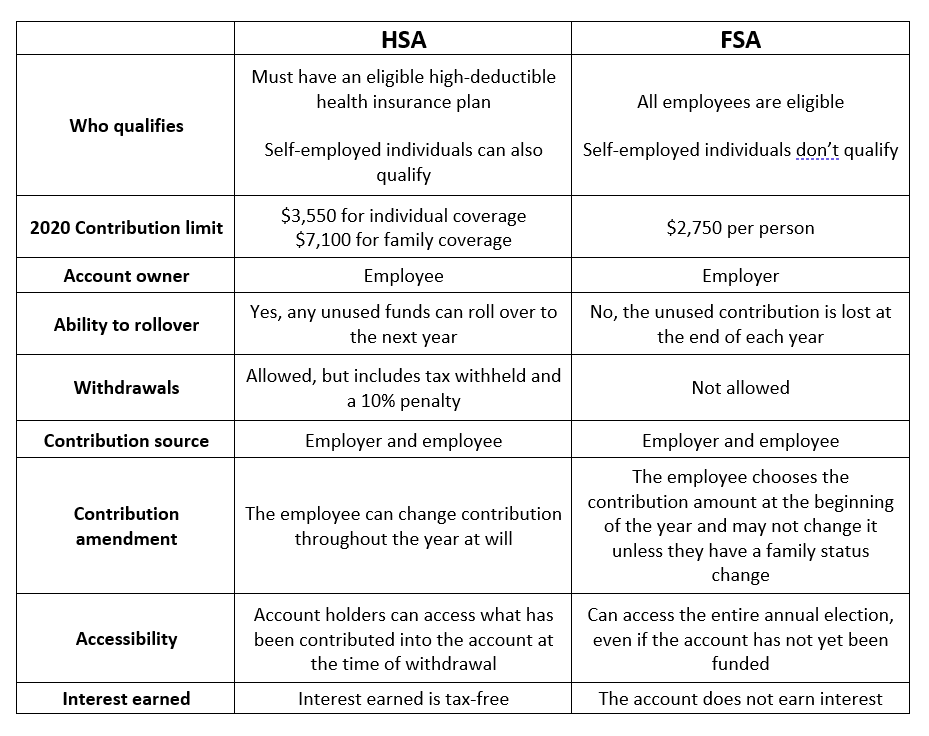

If your employer offers an FSA you can contribute up to 2750 pretax in 2020 and 2021 and use the money tax-free for a wide range of medical expenses. Its a tax-deductible savings account that you can use for a variety of expenses. FSA funds can be used to cover.

Health care and dependent care FSAs are employer-sponsored benefits which permit employees to set aside money on a pre-tax basis for the payment or reimbursement of eligible. But most FSAs have a Dec. If you dont spend the money by the.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. The IRS determines which. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. An Flexible Spending Account FSA is a valuable employee benefit that allows you to have pre-tax dollars withheld from your paycheck. Healthcare health-care or health care is the maintenance or enhancement of health by means of the avoidance diagnosis treatment recovery or remedy of illness disease injury.

Health Flexible Spending Account FSA 2020 Annual Limit of 2750 for Employee Contributions Healthcare reform imposed a 2500 limit on annual salary reduction contributions to health FSAs offered under 125 Cafeteria plans effective for plan years beginning after December 31 2012. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses. Health FSAs let workers stash away pretax money for qualifying medical expenses.

You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. You may use these funds to pay for eligible. Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on.

Allowed expenses include insurance copayments and. You may be able to roll over up to 550 in contributions from 2020 to 2021 and 570 from 2021 to 2022. 2020 FSA Contribution Cap Rises to 2750.

Reopening After The Shutdown Hsa Hra Fsa Expansion Eeoc Updates Preventing Burnout And More Crane

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Benefits Guidebook January 1 December 31 2020 By Wfu Talent Issuu

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

Boiron Hsa Fsa Eligible Medicines Boiron Usa

![]()

Covid Relief 2021 Implementing Fsa Rule Changes On Vimeo

Impact On Hsa Fsa And Hra Benefit Accounts Oca

Fsa Changes You Need To Know For 2022 Policygenius

2021 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Mercer Projects 2020 Commuter Health Fsa And Archer Msa Limits Mercer

Irs Releases 2020 Health Fsa And Commuter Limits Flexible Benefit Service Llcirs Releases 2020 Health Fsa And Commuter Limits

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

What Are The Differences Between Hsa Hra And Fsa Go Imaging

Which One Is Better For Me An Fsa Or Hsa Bri Benefit Resource

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer